Retention as a driver of efficient growth

A simple model to understand how big your recurrent revenue business can get

It is not surprising that customer retention and churn tend to be an afterthought in early-stage startups. Getting your first revenue in can be an achievement in itself, and product market fit occupies a large portion of the founders’ mental bandwidth. Will our product even stick?

But the moment that a company crosses that initial chasm (and congrats if you've made it to the other side!) a new question starts to creep up to the front of every discussion: how big can this get?

In recurring revenue businesses, this question can be calculated based on very few parameters and constraints, and the result is surprisingly simple. However, what is interesting about this framework is that one of the drivers that can disproportionately drive growth often does not get the attention it deserves.

A simple framework for steady-state revenue of a business

Provided you operate in a business that has a large market (ie. your TAM is not a constraint to how big you can become) and you can finance the business, then two main variables define how big your recurring revenue business can get:

New Revenue generation: how much $ can your sales team generate in new revenue (either expansion of existing customers, or new customer acquisition) every year.

Churn: what % of your existing revenue base cancels their contracts (either partial or full cancellation of existing contracts) every year.

If those two numbers stay constant for years to come, the business will grow gradually until it plateaus at a given revenue number. The plateau, or also known as steady state revenue number, is where the size of the business is so big relative to the new business that the % of churn of the entire business equals what the business is capable of generating in new business:

SSRevenue * Churn = New Revenue Generation

or, in other words, Steady State Revenue is:

SSRevenue = New Revenue Generation / Churn

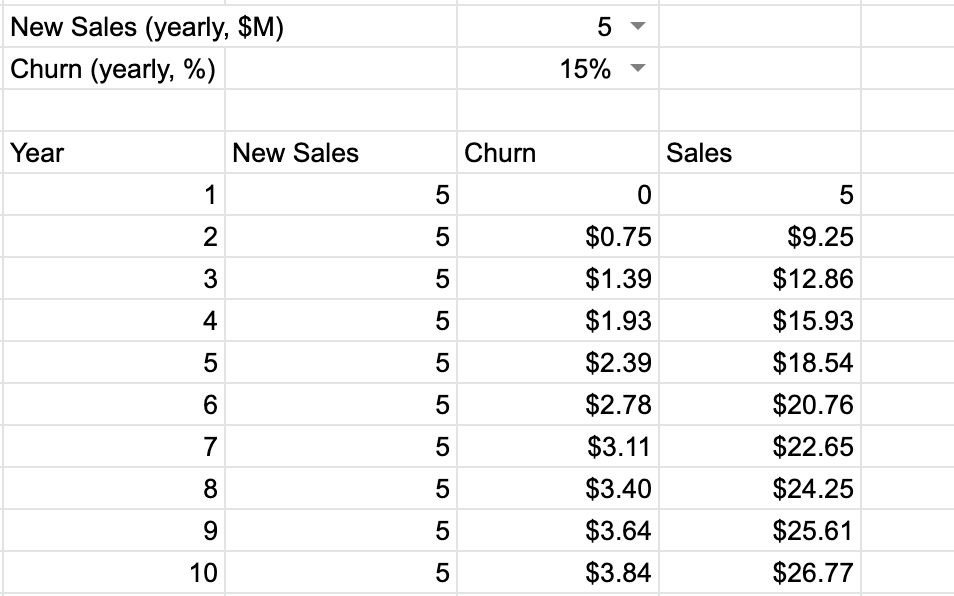

We've built a simple spreadsheet to understand how different values for new revenue generation and churn affect how big your business can get.

Some interesting conclusions

Due to the exponential nature of retention (it is a divider in the formula), linear improvements in retention have more impact than linear improvements in New Sales. For example: If you start with $1M in sales and 20% churn, your business will grow to become a $5M business per year. If you try to improve your business:

if you sell twice as much ($2M per year), but churn stays the same, it will grow to $10M a year business.

if you sell the same but increase your retention from 80% to 90% (a 12.5% improvement in retention), you will achieve the same steady-state size of $10M.

We've always found that this simple framework can help the team understand why retention can be a huge driver of revenue growth, and why focusing on retention and repeatability as opposed to "just” new sales growth, can be a more efficient way of growing.

What makes retention hard to manage is that it often comes at the sacrifice of sales (rejecting a deal that you know may not work long-term) when you may be in need of sales (cashflow reasons, to hit a goal, etc.). Investing in customer success and product, and deeply understanding your customer is quite an antinatural behavior (very similar to not procrastinating, or to saving rather than spending).

Also, if you scale a sales organization too quickly (before you've fully gone through several renewal cycles and honed in on what makes a customer renew) you may have taught your sales team the wrong way of selling (wrong value prop, wrong customer profile, etc.) and by then it may be very hard to change the ways your sales team should operate.